What is Contract Pull Through?

The pharma sales team engages in contracts with brands, hospitals, clinics, infusion centers, doctor offices, IDNs, ONA, GPOs, and other networks. These networks are often referred to as pharma accounts, and contracts are lined up to improve overall sales, market share, and profitability. Contracts with these accounts are based on various factors such as rebate percentage, formulary tiers, and performance-based fees.

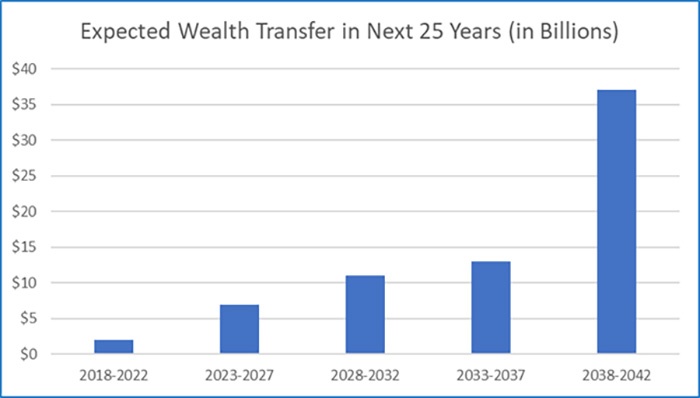

Pharma’s gross contracted sales is a large multi billion dollar opportunity which is growing at a rapid pace. This is a big opportunity for the commercial team to boost sales with these accounts. Pharma companies analyze data on contracts, rebates, terms, and tiers to see how accounts perform. This enables them to identify accounts that are doing poorly and the ones that are doing exceptionally well.

We may define Contact Pull Through, as the analysis of –

- How much an account has purchased (sales) by contract program and by brand;

- How much they’ve received in discounts (rebates, chargebacks);

- How they are doing against their baselines; and

- Where are the opportunities to buy more and save more?

Why does pharma need to focus on Contract Pull Through?

Large and mid-size pharma companies have Contract Pull Through from the accounts, as the top-of-mind problem, as even increasing effectiveness by 2-5% would mean savings to the tune of millions of dollars.

Based on our experiences working with the client’s market access team – we realized that the organization delegated the task of supporting field pull-through entirely to its payer account managers. These executives reported spending 75% of their time creating and pulling reports, time that could have been better spent with customers or in more strategic dialogue with the field members.

The key stakeholders for Contract Pull Through are the field team members i.e., Business Engagement Managers (BEMs) and Healthcare Market Directors (HDs), who need to focus on Contract Pull Through for –

- Generating contract awareness and pull through for major providers in their ecosystems

- Creating awareness around the contracts/terms offered by pharma firms for the products

- Engaging with customers to show their historical performance and current performance

Some specific Contract Pull Through use cases the pharma account team focuses on include:

- A portfolio purchasing summary of the account, which enables the account to understand how much volume the account has bought, and the savings received from pharma products

- Product contribution at an account level, which enables the understanding of how much volume is coming from each pharma product

- Contract eligibility of an account, to understand which contracts are available at a certain account

Other business insights that Contract Pull Through data may help pharma companies are around –

- How is the account performing as compared to others, in their ecosystem/region?

- Which is the account’s dominant payer, and how does that payer work at a national level?

- How much can this account purchase to reach the next tier?

Use case deep dive: Portfolio purchasing summary of an account

A portfolio purchasing summary of the account is one of the critical use cases handled through Contract Pull data – what the Contract Pull Through team is looking for is to understand a particular account within a regional ecosystem, across all periods of the contract or for a particular period –

- What has been the number of gross sales? Has that gone up or down compared to its last quarter?

- What part of the total gross sales is contracted vs non-contracted? What part of sales is attributed to specialty pharmacy? What percentage of account savings is attributed to contracting?

Also, another key insight to look at for portfolio purchasing summary for the account is to identify the product mix/segment mix (GPO, 340B, NCCN, etc.) across the portfolio, and double click on which product/ segment contribution has gone up, or down over the previous periods, and how does it fare against its anticipated baseline numbers.

These insights help field teams understand account purchase volume, savings from contracted products, account performance compared to expectations, and identify opportunities for cost-saving purchases.

How to generate the pull through business insights from data?

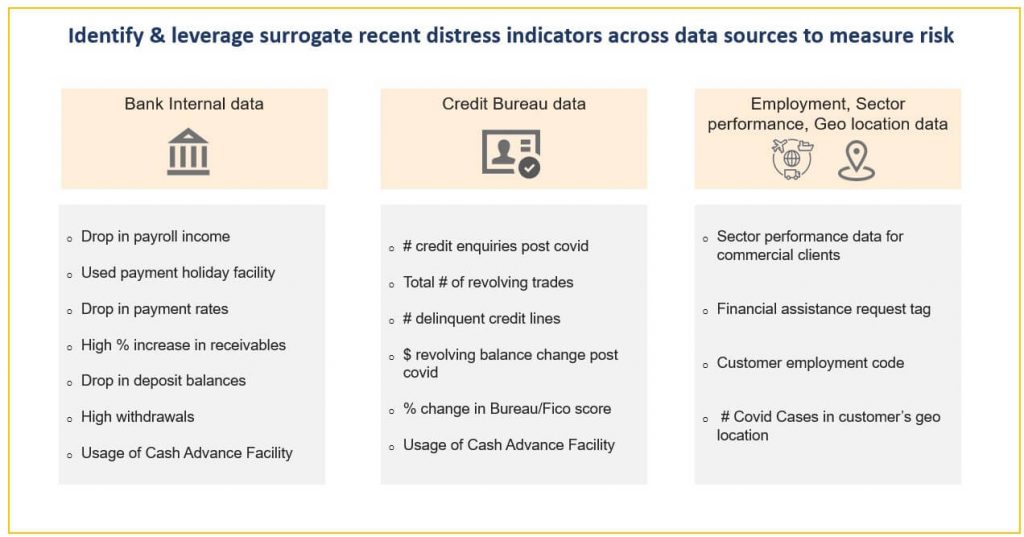

To arrive at these insights- the key data elements that must be looked into are contracts, chargebacks, 867 Sales, non-contracted sales, rebates, terms and tiers, account hierarchy, and zip to territory-mapping data.

These data sets coming from different source systems are ingested, assimilated, and presented as output for improved decision-making –

- Firstly, it needs to be ingested into cloud-based or on premise databases by using RPA tools like UIPath

- The ingested data then goes through a set of data quality checks to ensure data is of expected quality.

- The clean dataset then is transformed through the ETL process, where complex calculations through business-defined rules are applied, and

- Presented through BI tools reports providing visualized/graphics and tabular data on gross sales, savings, performance, opportunities for an account, and other pull through insights.

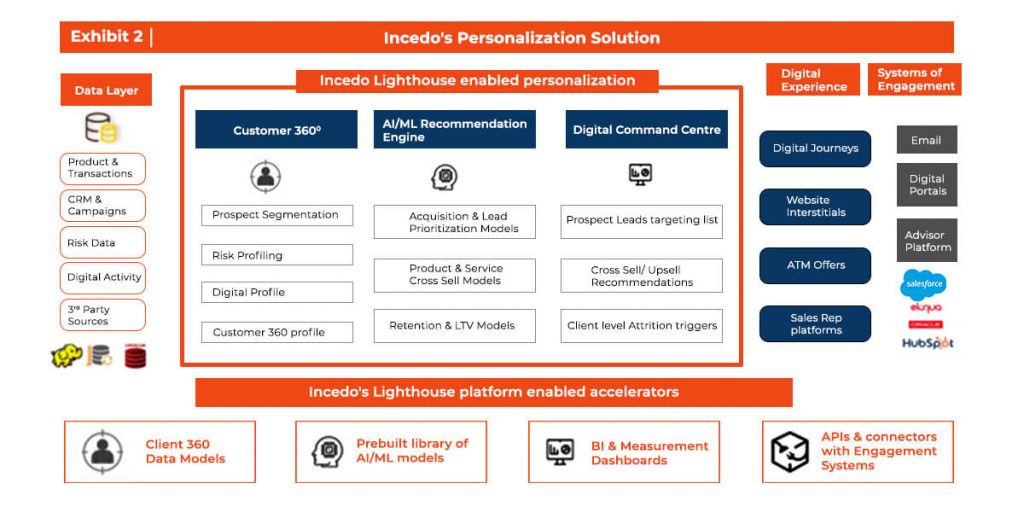

Unlocking Insights with Incedo’s Data and analytics services on AWS environment

With broad and relevant expertise on data and analytics solutions on AWS cloud, Incedo offers Data and Analytics services in database transformation with data ingestion, data preparation, modernization, archival, integration with data warehouses, formation of data lakes in AWS, real time and operational analytics, business analytics, visualization and data governance. These services provide a holistic view of specific accounts in regional ecosystems, breakdown of sales components, and product/segment analysis. This empowers field teams to optimize their strategies and enhance Contract Pull Through effectiveness in the pharmaceutical industry.

AWS SageMaker provides an effective solution for creating an efficient data processing pipeline. Data was collected from various sources including contracts, chargebacks, 867 Sales, non-contracted sales, rebates, terms and tiers, account hierarchy, and zip to territory-mapping data. Once the data is ingested, SageMaker supports a set of data quality checks to verify that the data meets the expected quality standards, guaranteeing data integrity. After ensuring the data’s accuracy, it allows a transformation process involving complex calculations based on predefined rules.

Amazon QuickSight offers a powerful solution to present results through visually appealing reports and dashboards, employing Business Intelligence tools. Incedo’s strategic approach leveraged these capabilities to empower stakeholders in the pharmaceutical industry. This enables them to make informed, data-driven decisions and optimize their Contract Pull Through strategies effectively. With Amazon QuickSight, complex data is translated into comprehensible visual insights, facilitating better decision-making and ultimately enhancing the pharmaceutical industry’s operational efficiency.

Conclusion:

BEMs/ HDs pay significant attention to generating Contract Pull Through insights. Thus, large and mid-sized pharmaceutical companies should invest in a robust system to understand account performance, optimize rebates, and potentially save millions of dollars. This also aids in focusing on top accounts and renegotiating terms for underperforming ones.