In today’s fast-paced business landscape, where efficiency, accuracy, and cost savings reign supreme, organizations are increasingly turning to automation to streamline their financial operations. According to the Institute of Financial Operations & Leadership, only 9 % of Accounts Payable (AP) departments are fully automated today. However, – the Strategic Treasurer survey reveals that, by 2025 67%s of finance professionals anticipate their AP departments will be entirely automated. This transformation is driven by an emphasis on cost savings, with 73% of organizations stating that it is the primary motivator for shifting to fully electronic processing. This shift bolsters both an organization’s operational efficiency as well as its financial health.

In this blog, we will explore why and how automating the Accounts Payables process is vital and delve into the myriad benefits of IncedoPay in achieving this transformation. Further, we will elaborate how IncedoPay eliminates the need for upfront enterprise investments in infrastructure, hosting fees, and licenses. It addresses critical customer challenges by reducing capital expenditure (Capex) and operational costs, thanks to its deployment on the AWS cloud and its service model based on per-payment transaction costs.

The Need for AP Automation: The traditional AP process is manual and resource intensive, – involving tasks such as data entry, invoice verification, purchase order matching, and physical check handling. This manual approach is both time-consuming and error-prone, leading to delayed payments, inefficiencies, supplier frustrations and potential compliance issues. AP Automation can help overcome these challenges by:

- Streamlined Workflow: Automation of the AP process facilitates a seamless and well-structured workflow. Purchase orders & invoices are electronically captured, verified, and routed through approval workflows, reducing the risk of errors and fraud. This expedites payment cycles and enables organizations to take advantage of early payment discounts, optimizing cash flow.

- Enhanced Visibility and Control: Automated AP systems provide real-time visibility into financial data, offering better tracking of financial commitments. This transparency facilitates more informed decision-making about cash flow and liabilities while ensuring compliance with financial regulations and reporting requirements.

- Cost Reduction: Manual AP processes incur hidden costs, of which labor costs constitute the most significant portion. Automation eliminates these expenses, resulting in significant cost savings. Improved cash flows with visibility and control over the liquidity allows organizations to not only reduce costs but to enhance forecasting and spend management.

- Vendor and Supplier Relations: Timely and accurate payments foster positive relationships with vendors and suppliers. Automated AP systems streamline the processes effectively to ensure that payments are made promptly and accurately, reducing the risk of disputes and enhancing trust among business partners.

IncedoPay – Revolutionizing the Accounts Payable Landscape for Banks and Enterprises:

IncedoPay, a proprietary payments platform from Incedo Inc., empowers enterprises to automate the process of Accounts Payables (AP) by integrating multiple payment systems while maintaining control, governance, and payment approval. IncedoPay stands as a beacon of innovation and excellence in the realm of integrated payment solutions, tailored specifically for banks and their corporate customers. As a best-in-class platform, IncedoPay harnesses the power of automation to revolutionize every facet of the Accounts Payable (AP) lifecycle, elevating profitability, productivity, and the overall user experience.

IncedoPay redefines the banking experience by seamlessly integrating digital solutions. With self-service portals catering to various stakeholders (eg. bank and their corporate customers) and personalized payer & payee journeys, to offer unmatched convenience to users. Real-time visibility and payment tracking further enhance the overall user experience. The platform streamlines multiple payment methods, including RTP, ACH, PayPal, Zelle, virtual cards, checks, and prepaid cards onto a user-friendly platform. Through the consolidation of legacy systems, IncedoPay enhances user experiences, transforming the way businesses handle their financial transactions.

IncedoPay isn’t just a payment platform; it’s an innovation-led, secure, and efficient payment solution. It adheres to the most stringent industry standards. It empowers banks with proactive fraud reduction and regulatory compliance management by analysing transactional data such as vendor details, payment amount and terms etc to identify anomalies or suspicious activities. This includes sentiment analysis and transactional data analytics. Replacing legacy applications, boosts business performance and unlocks upsell/cross-sell opportunities through data-driven decision-making.

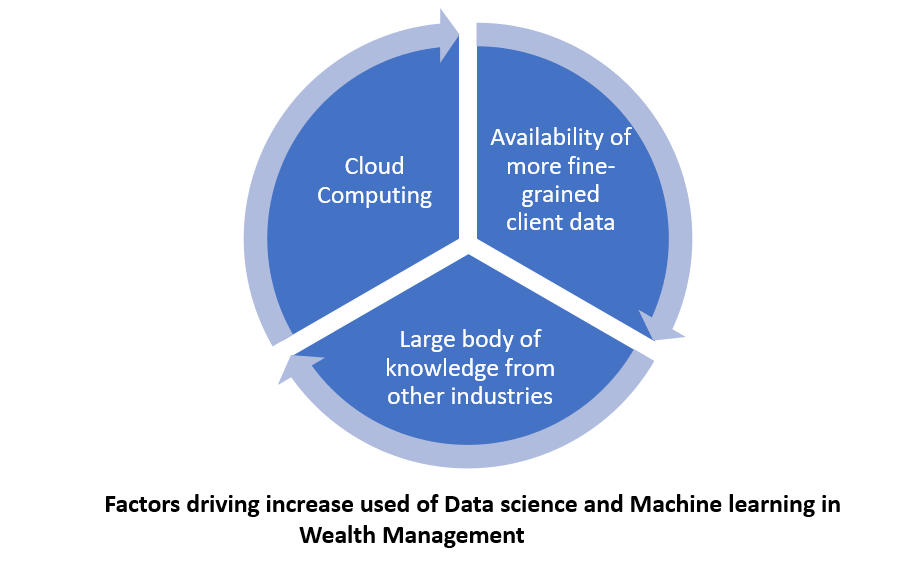

Elevating Payments with Innovation, Security, and Reliability with AWS

IncedoPay is powered by Amazon Web Services (AWS), a powerhouse in the realm of cloud computing. AWS empowers IncedoPay to redefine the digital payment landscape, offering high-performance, secure, and scalable solutions. In the online payment world, security is paramount. AWS Key Management Service ensures the security and compliance of IncedoPay’s data. Web Application Firewall stands as the first line of defense, guarding against threats and ensuring uninterrupted service. Combining Availability Zones, Auto Scaling, and Elastic Load Balancing, ensures business continuity and cost-efficiency. Elastic Kubernetes Service (EKS) allows IncedoPay to swiftly adapt to market demands and Relational Database Service (RDS) enhances resilience, scalability, and compliance. The platform optimizes performance through caching and continuously monitors and optimizes resources with Amazon CloudWatch.

With global supply chains, late payments, evolving regulations, uncertainties, and cybersecurity threats, risk and compliance management become paramount. IncedoPay adheres to the most stringent industry standards. It empowers banks with proactive fraud reduction and regulatory compliance management through the use of information, sentiment analysis, and transactional data analytics.

IncedoPay’s remarkable impact is clearly demonstrated through the key statistics derived from its wide range of customer deployments:

- Cost Reduction: IncedoPay has achieved substantial cost savings, with one of our customers experiencing an astounding 80% reduction in processing costs. Another one realized an impressive 37% reduction in operations costs.

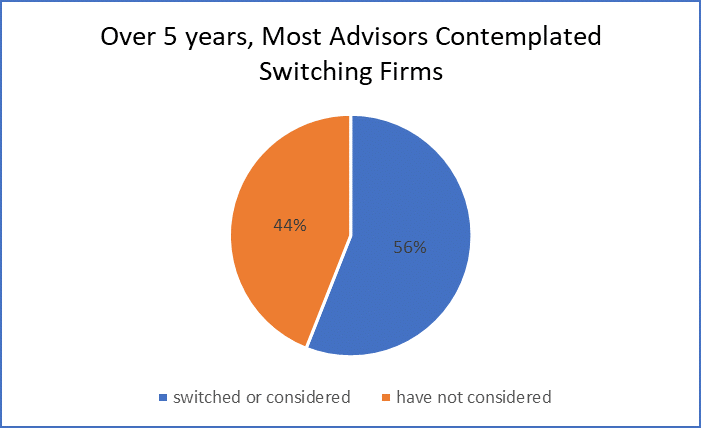

- User Adoption: IncedoPay’s modular architecture, coupled with tailored campaigns, has significantly boosted user adoption rates. In one instance, digital payment usage soared by 2x, while new supplier outreach increased sixfold. The platform streamlines the process of onboarding new suppliers, capturing their payment details, alerting them about payments, and providing regular metrics on their business relationships.

- Enhanced Efficiency: The platform’s seamless integration and comprehensive payment options have streamlined legacy processes and significantly reduced processing times. This improvement is evident in the 70% reduction in support requests from suppliers experienced by one of our customers, enhancing business cohesiveness.

Automation is critical for organizations to optimize cash flow, reduce costs, enhance financial control, and strengthen relationships with key stakeholders. Embracing this change enables businesses to thrive in an increasingly competitive financial landscape. So don’t wait; start your journey toward a more efficient and prosperous financial future today.